Introduction: Affordable Health Insurance in Silchar

Medical costs continue to rise every year, and even a short hospital stay can put pressure on a family’s savings. Because of this, many people in Silchar are now searching for affordable health insurance that gives real protection during emergencies. Whether you are a student, a working adult, or taking care of a family, choosing the right health plan matters for your financial safety.

But health insurance policies can feel confusing. There are different terms, waiting periods, hidden conditions, and premium differences that can make it hard to decide. This is why many people prefer taking help from a trusted insurance agent Silchar who understands local needs and explains everything in simple language.

This complete guide will help you choose the best health insurance advisor in Silchar, compare plans easily, understand costs, avoid mistakes, and feel confident when selecting a policy in 2025.

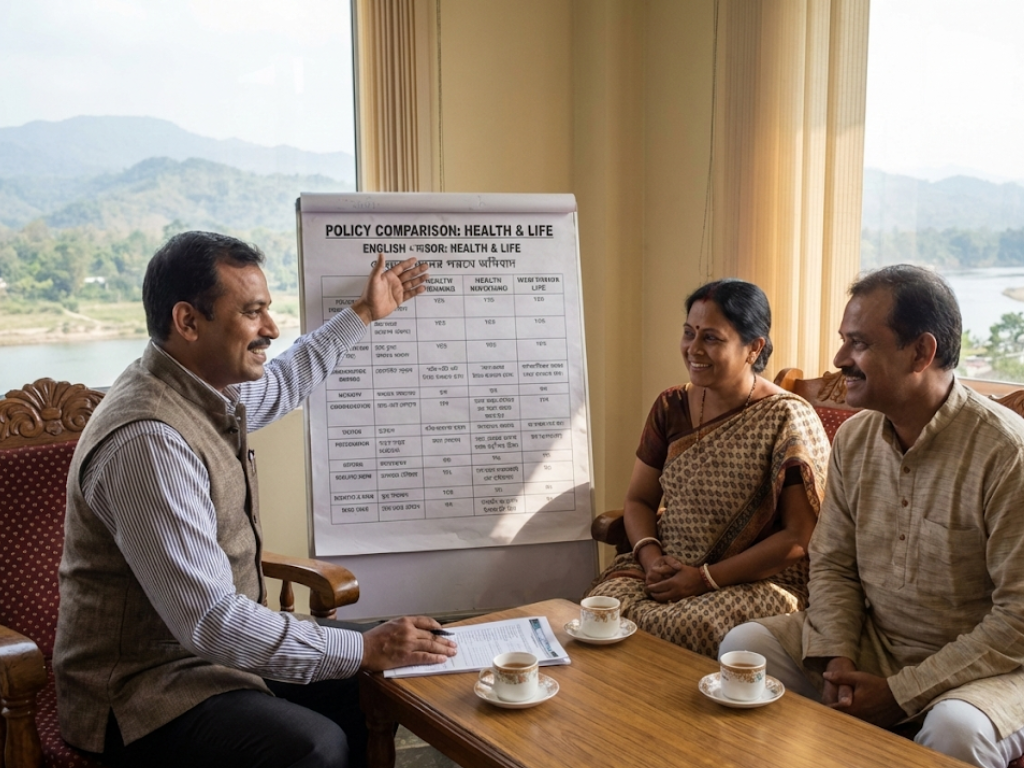

What a Health Insurance Advisor Does

A health insurance advisor guides you through the process of choosing the right plan. Their job is not only to sell a policy but to help you make a safe financial decision for your future.

An advisor helps you with:

-

Comparing different insurance plans

-

Understanding policy benefits, exclusions, and costs

-

Selecting the right coverage for your family size and age

-

Explaining cashless treatment options in Silchar

-

Supporting you during claims and emergencies

-

Helping you renew policies on time

-

Suggesting upgrades if your needs change

A good advisor focuses on your needs, not on commissions.

Types of Health Insurance Plans Available

There are many types of plans in India, and knowing the differences helps you choose wisely.

Individual Health Insurance

This covers one person. Premium is usually lower for young adults.

Family Floater Insurance

One plan covers the whole family, making it a cost-effective choice for parents and children.

Senior Citizen Insurance

Designed for people over 60. It offers support for age-related illnesses and hospitalization needs.

Critical Illness Insurance

Provides a lump-sum payout if diagnosed with serious diseases like cancer or stroke.

Top-Up and Super Top-Up Plans

Useful when you want higher coverage without paying a high premium.

Personal Accident Insurance

Gives financial protection in case of accident-related injury or disability.

How to Choose the Right Health Insurance Advisor in Silchar

Choosing the right advisor ensures you receive transparent guidance and reliable claim support.

Check IRDAI License

A valid license shows the advisor is trained and authorized.

Ask About Experience

Experienced advisors understand plan details better and handle claims smoothly.

Know Which Insurance Companies They Represent

Advisors who work with multiple insurers offer more variety and better comparison.

Check Communication Style

They should explain everything clearly and patiently.

Ask About Claim Assistance

Good claim support is more important than buying the plan itself.

Look for Local Recommendations

Ask neighbours, relatives, and friends in Silchar whom they trust.

Important Features to Compare Before Buying Insurance

Before choosing an affordable health insurance plan, compare these key features:

Sum Insured

Choose coverage that matches your family’s needs. ₹5–10 lakh is common for individuals; ₹10–20 lakh for families.

Room Rent Conditions

Plans without room rent limits offer more flexibility in hospitals.

Waiting Period

Shorter waiting periods are better, especially for pre-existing diseases.

Pre- and Post-Hospitalization Cover

Look for plans that cover doctor visits, medicines, and tests before and after hospitalization.

Daycare Procedures

Covers treatments that do not require 24-hour hospital stay.

Network Hospitals in Silchar

Cashless treatment is available only at network hospitals. Check for:

-

Silchar Medical College & Hospital

-

Green Heals Hospital

-

Valley Hospital

-

Jeevan Jyoti Institute of Medical Sciences

Exclusions

Always check what is NOT covered.

Cost of Health Insurance in Silchar

Premiums vary based on age, medical history, plan type, and coverage.

Average Premium Range in Silchar:

| Plan Type | Age Group | Approx Yearly Premium |

|---|---|---|

| Individual Plan | 25–35 years | ₹5,000–₹12,000 |

| Family Floater (4 members) | Any | ₹12,000–₹35,000 |

| Senior Citizen Plan | 60+ | ₹25,000–₹60,000 |

| Critical Illness Plan | 30–45 | ₹3,000–₹15,000 |

Premiums may increase at renewal depending on age and health.

ALSO READ: Thyroid Vs Weight Gain: Everything You Need To Know

Why Affordable Health Insurance Matters Today

Financial Protection

Even a simple surgery can cost thousands of rupees. Insurance protects your savings.

Cashless Medical Treatment

You can get treatment without paying upfront if the hospital is in the network.

Peace of Mind

You don’t have to worry about sudden medical expenses.

Better Access to Healthcare

People with insurance visit hospitals sooner and get timely treatment.

Common Mistakes to Avoid When Buying Health Insurance

-

Choosing the cheapest plan without checking coverage

-

Not reading exclusions

-

Not disclosing existing health conditions

-

Ignoring room rent limits

-

Choosing low coverage to save money

-

Not comparing different insurers

Avoid these mistakes to prevent claim problems later.

When You Should Buy Health Insurance

-

As early as possible (younger = lower premium)

-

After marriage or starting a family

-

When planning for parents’ health needs

-

When employer insurance is not enough

The earlier you buy, the better your coverage and future stability.

Role of a Local Insurance Agent in Silchar

A trusted agent helps you throughout the health insurance journey.

Helps Compare Plans

Saves time by analyzing options based on your needs.

Guides During Claims

Many people struggle during claims; a local agent makes the process easier.

Offers Personal Support

Understands local hospitals and procedures in Silchar.

Sends Renewal Reminders

Prevents accidental policy lapse.

Documents Needed for Buying Health Insurance

-

Aadhaar card

-

PAN card

-

Address proof

-

Passport-size photo

-

Medical reports (if required)

Keeping documents ready helps speed up the buying process.

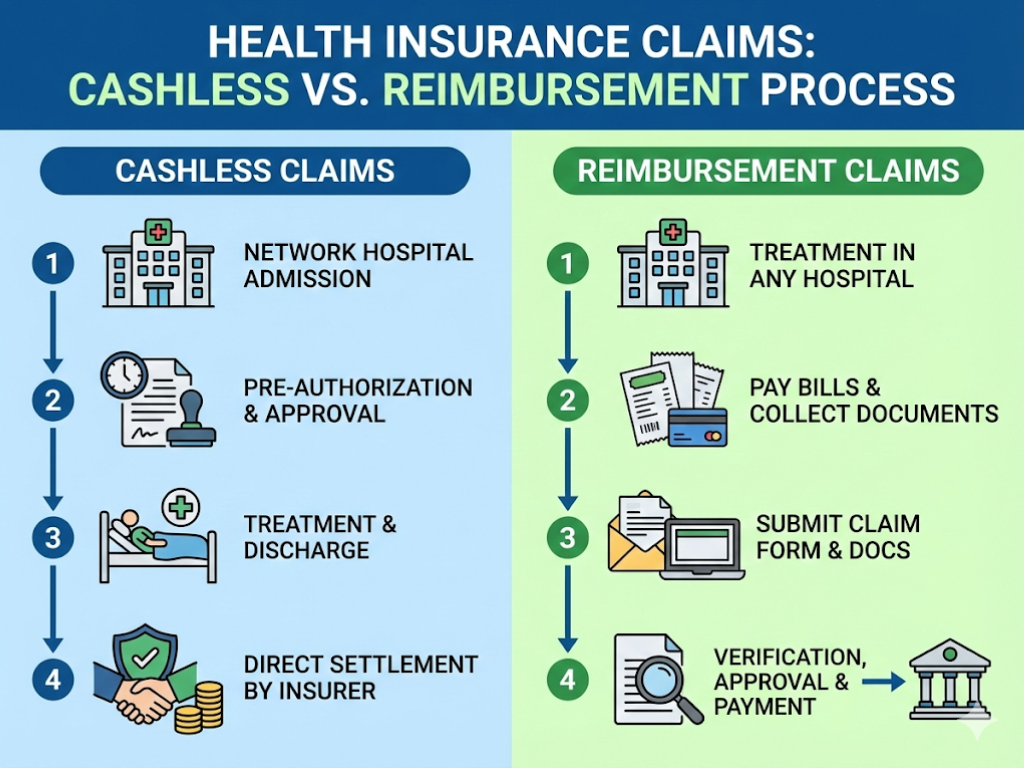

How to File a Health Insurance Claim Easily

Cashless Claim Steps:

-

Visit a network hospital

-

Show your insurance card and ID

-

Hospital sends approval request

-

Start treatment after approval

Reimbursement Claim Steps:

-

Pay the bills yourself

-

Collect all documents

-

Submit claim within the deadline

-

Insurer reimburses after verification

Tips to Choose the Right Plan Easily

-

Choose plans with no room rent limit

-

Select insurers with a high claim settlement ratio

-

Prefer cashless hospitals near your home

-

Avoid very cheap plans

-

Choose enough coverage for your family

50 Frequently Asked Questions (FAQs)

1. What is the best age to buy health insurance?

The best time is when you are young because premiums are lower.

2. Is affordable health insurance enough for a family?

Yes, if you choose the right sum insured and benefits.

3. Can an insurance agent in Silchar help me compare plans?

Yes, agents guide you through different policies and features.

4. What is cashless hospitalization?

It allows you to get treatment without paying upfront.

5. What is a waiting period?

The time you must wait before certain diseases are covered.

6. Do all policies cover pre-existing diseases?

Yes, but only after the waiting period.

7. Can I buy health insurance for my parents?

Yes, many insurers offer senior citizen plans.

8. Why do premiums increase every year?

Due to age, inflation, and rising treatment costs.

9. What is room rent limit?

The maximum room cost covered per day.

10. What if my hospital is not in the network?

You can still take treatment through reimbursement.

11. Do agents help with claims?

Yes, a good agent supports you during claims.

12. What is co-payment?

A part of the bill you pay yourself.

13. Can I upgrade my policy later?

Yes, you can increase coverage during renewal.

14. Does insurance cover pregnancy?

Only maternity plans do, with waiting periods.

15. What is no-claim bonus?

A reward for not making claims in a year.

16. Which is better: individual or family plan?

Family plan is better for families; individual suits singles.

17. What is deductible?

The amount you pay before insurance starts covering.

18. Can I buy multiple health policies?

Yes, you can have more than one.

19. What is a top-up plan?

Extra coverage at a low cost.

20. How do I know the claim settlement ratio?

Insurers publish it every year.

21. Does insurance cover dental care?

Usually no, unless mentioned.

22. Is COVID-19 covered?

Yes, most policies now cover it.

23. How long does claim approval take?

Cashless approval may take a few hours.

24. Can I buy insurance after I become sick?

You can, but waiting periods apply.

25. Do plans cover daily doctor visits?

Only if OPD cover is included.

26. Is insurance cheaper for women?

Premium depends more on age than gender.

27. Are check-ups covered?

Some plans offer free health check-ups.

28. What happens if I forget to renew?

Coverage stops; a grace period may apply.

29. Do children get coverage?

Yes, family floaters include children.

30. Can I claim twice in a year?

Yes, up to your sum insured limit.

31. Will premiums drop if I stay healthy?

Usually no, but no-claim bonuses increase coverage.

32. Are accidents covered?

Yes, under personal accident or health plans.

33. Can I change my insurer?

Yes, through portability.

34. Are medicines covered?

Yes, during hospitalization.

35. Do policies cover mental health?

Many now include mental health coverage.

36. Is ambulance cost covered?

Most plans include it.

37. What documents are needed for claim?

Bills, prescriptions, discharge summary, and ID.

38. What is lifelong renewal?

The insurer must allow renewal at any age.

39. Are cosmetic surgeries covered?

No, unless medically required.

40. What is sum insured?

The maximum amount the insurer pays in a year.

41. Can I take a plan from outside Silchar?

Yes, policies work across India.

42. Is my insurance valid at SMCH?

Check if SMCH is in your insurer’s network.

43. What if my claim is rejected?

You can appeal with proper documents.

44. How long is the waiting period for maternity?

Usually 2–4 years.

45. Do senior plans need medical tests?

Often yes, depending on health.

46. Can I buy insurance online?

Yes, it is easy and quick.

47. Can an agent help me renew?

Yes, they remind and assist with renewal.

48. Are tests before surgery covered?

Yes, under pre-hospitalization cover.

49. Are day-care surgeries covered?

Yes, most plans include them.

50. What is the biggest benefit of having insurance?

Financial protection during medical emergencies.

Conclusion

Choosing affordable health insurance in Silchar becomes easier when you understand your needs, compare plans, and take help from a trusted insurance agent Silchar. A good plan protects your savings, provides cashless treatment, and gives peace of mind during emergencies. Always compare policy features, read exclusions carefully, check network hospitals, and choose coverage that fits your family’s health needs.

With the right advisor and the right plan, you can protect your family’s future with confidence.

Book Health Insurance Advice on Quickobook

-

Find verified insurance advisors in Silchar

-

Compare plans easily

-

Get guidance in simple language

-

Claim support when needed

Visit Quickobook today to book your consultation.

Disclaimer

This blog is for educational purposes only and does not replace professional financial or medical advice. Always read policy documents carefully and consult a licensed insurance advisor before buying any plan.

Comments (0)

No comments yet. Be the first to share your thoughts!

Leave a Comment